Experienced, Principled, and Strong Leadership

Representing District 43 of Kansas

CALL or TEXT

Blog Layout

Week 4 Update: Talking points

7111885060 • February 11, 2025

Week 4 Update

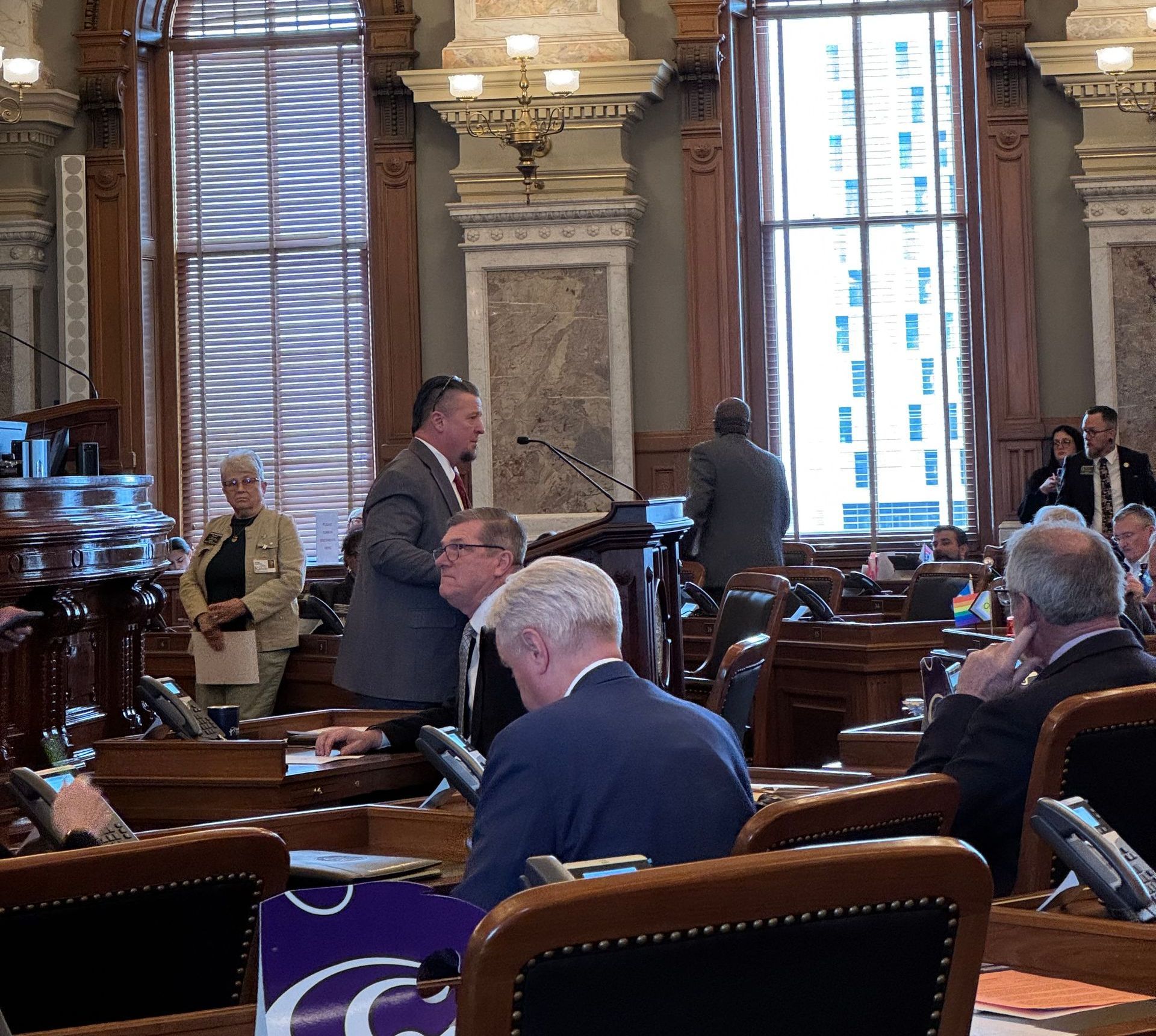

Citizens-Only Voting Passes the House

Kansas stands at a pivotal moment. HCR 5004, the Citizens-Only Voting amendment, has passed the House and now moves to the Senate. This measure is not merely a procedural adjustment—it is a reaffirmation of our commitment to the integrity of our electoral system, a system built upon the fundamental principles of democracy.

Within our state’s constitution, a shadow of ambiguity has lingered—one that raises the question of whether only U.S. citizens may vote. This amendment eradicates any doubt. It makes clear that only those who are U.S. citizens, 18 years or older, and residing within the appropriate voting district are eligible to cast a ballot.

This is not an act of exclusion—it is an act of preservation. The right to vote is a privilege, and with privilege comes responsibility. By ensuring that our elections reflect the will of those who are bound by duty and allegiance to this nation, we safeguard democracy itself.

________________________________________

Ending Digital Child Exploitation

There is no cause greater, no duty more sacred, than the protection of our children.

House Bill 2183 is more than legislation—it is a shield, forged to protect the innocent from those who would seek to exploit them. The rise of digital manipulation—deepfakes and the unlawful distribution of illicit images—has introduced new threats, new horrors that demand action.

Kansas will not be a safe harbor for those who prey upon the vulnerable. This law strengthens penalties, closes dangerous loopholes, and ensures that those who engage in the exploitation of children, whether through direct abuse or digital deception, face the full weight of justice.

We stand for family. We stand for dignity. And above all, we stand for the safety of our children.

________________________________________

Closing Constitutional Confusion

A government that is unclear in its governance is a government that sows uncertainty among its people.

House Bill 2057 is an essential reform—one that brings order, clarity, and accountability to the appointment process for key state offices, including the United States Senate. As established by the 17th Amendment, the legislature holds the power to define the parameters by which the Governor may appoint a replacement Senator. This bill ensures that such appointments remain true to the will of the people.

Kansas will not be subject to political whims or reckless appointments. By requiring that nominees maintain party affiliation and residency stability, this legislation ensures continuity, stability, and above all, integrity. A bipartisan committee will oversee this process, guaranteeing that any appointment is subject to scrutiny, fairness, and public trust.

In Kansas, we do not govern in shadows. We lead with transparency, with accountability, and with the unshakable principles that define our democracy.

________________________________________

Veteran Property Tax Relief—Honoring Those Who Have Served

A nation that does not honor its veterans is a nation that does not honor itself.

With House Bill 2005, Kansas takes a decisive step to ease the financial burden on those who have given everything for this country. The Veterans' Valor Property Tax Relief Act provides a 75% tax credit for veterans deemed totally disabled, permanently and totally disabled, or unemployable under federal guidelines.

This is not charity. This is justice.

By allowing eligible veterans to claim this credit against property taxes on their primary residence, we ensure that those who have borne the weight of sacrifice are not burdened further. And we do so with fairness—ensuring that aid reaches those most in need, without redundancy or waste.

This law is a promise—a promise that Kansas will never forget the men and women who have defended its freedoms. To our veterans, we do not merely offer words of gratitude. We offer action.

________________________________________

Kansas moves forward. Not with uncertainty, but with purpose. Not with hesitation, but with strength.

Let the record show: We stand for democracy. We stand for justice. We stand for the people.

March 11, 2025

Countdown to March 25th: The Final Stretch Week 8 of the legislative session is in the books, and now we’re racing toward March 25th. Why does this date matter? Because that’s the deadline for getting bills passed if there’s a chance they’ll get vetoed. The Kansas Constitution requires the Governor to make a decision within a set timeframe, and we need at least three days to override any veto if necessary. So yeah, it’s crunch time. Property Taxes: Power to the People Let’s talk property taxes, because let’s be honest, they never go down. That’s why HB 2396 is a game-changer. This bill does three important things: Gives Kansans the power to challenge ridiculous property tax hikes through a protest petition. If your local government tries to pull a fast one, you can fight back. Creates the ASTRA Fund—a pool of state money to help cities and counties that keep tax increases in check. Responsible budgeting should be rewarded, not punished. Cuts outdated red tape that slows down the system and makes taxes more confusing than they need to be. Bottom line? This bill puts taxpayers back in control. No more automatic, sneaky tax increases. Local governments have to be transparent, justify their spending, and actually be accountable. Imagine that. For homeowners, business owners, and farmers, this means stability. No more getting taxed out of your own home. No more surprise hikes that crush small businesses. Just fair, predictable, common-sense tax policy. The Lesser-Expensive of Two Evils: House Concurrent Resolution No. 5011 is a serious step toward fixing Kansas’ outdated property tax system. Right now, valuations swing wildly based on short-term market fluctuations, which is just insane. This amendment fixes that by using the lower of the fair market value or a multi-year average to determine taxable value. Translation? No more getting wrecked by sudden spikes in property values. Predictability. Stability. A tax system that actually makes sense. At its core, this is about fairness. The government shouldn’t be a predatory entity that punishes success. If you work hard, buy a home, or build a business, you shouldn’t get blindsided by unpredictable tax increases. This amendment makes sure taxation remains a tool for public service, not a weapon against taxpayers. Free Speech & Campaign Contributions: Fixing an Outdated System: Money is speech. The courts have said it, and honestly, it’s common sense. That’s why HB 2054 updates Kansas’ campaign finance laws to reflect reality. Right now, the max individual donation for House races is $500, basically half of what it was worth in the ‘90s due to inflation. So we’re bumping it to $1,000. Why? Because if we don’t, we’re effectively suppressing Kansans’ political voices. Inflation already devalues everything else; why let it devalue democracy too? Oh, and let’s talk about political parties. Right now, there are limits on contributions to them, but not on Super PACs. That’s ridiculous. Super PACs raise unlimited money with little oversight, while political parties have to follow strict rules and disclose their donors. By removing caps on party donations, we’re making the system more transparent, not less. If you care about accountability, this is the way to go. We’re at a pivotal moment. The decisions we make in the next few weeks will determine how Kansas handles taxes, governance, and political transparency for years to come. The goal? Less bureaucracy, more accountability, and policies that work for the people who pay the bills. Let’s get it done. — Rep. Sutton

March 11, 2025

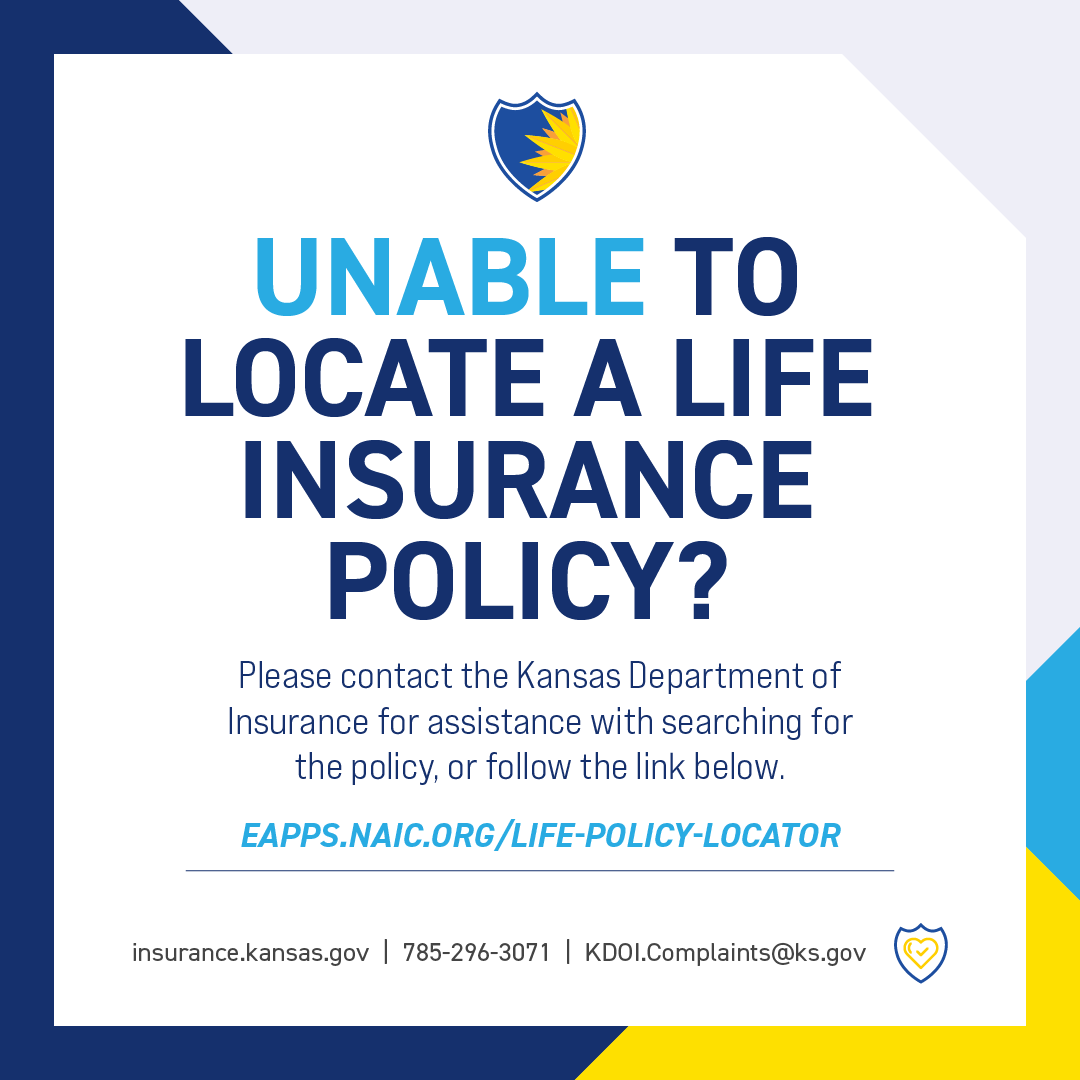

Hello Everyone, As your representative, I want to ensure that you and your loved ones have access to all the resources available to protect your financial well-being. If you or someone you know is struggling to locate a lost life insurance policy, the Kansas Department of Insurance is here to help. Kansas Insurance Commissioner Vicki Schmidt has shared a valuable resource that could assist constituents in finding missing life insurance funds. Through the **National Association of Insurance Commissioners (NAIC) Life Insurance Policy Locator**, individuals can perform a **nationwide search** for lost life insurance policies by providing key information such as the deceased's Social Security number, legal name, date of birth, and date of death. Since 2019, the **Kansas Department of Insurance has helped Kansans recover over $98 million in life insurance policies**. This tool is a crucial asset for families looking to secure the benefits that their loved ones intended for them. To begin your search, visit the **Life Insurance Policy Locator** here: [https://eapps.naic.org/life-policy-locator](https://eapps.naic.org/life-policy-locator). For more information on life insurance and related services, visit the Kansas Department of Insurance website: [https://insurance.kansas.gov/life-viatical](https://insurance.kansas.gov/life-viatical). If you have any questions or need further assistance, please don’t hesitate to reach out. I am committed to ensuring that every Kansan has access to the support and resources they need.

Serving Area

Gardner, KS

and surrounding areas

Paid for by the Committee to Elect Bill Sutton, Mark Baldwin Treasurer

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Hi. Do you need any help?

Privacy Policy

| Do Not Share My Information

| Conditions of Use

| Notice and Take Down Policy

| Website Accessibility Policy

© 2025

The content on this website is owned by us and our licensors. Do not copy any content (including images) without our consent.

Share On: